Traditional financial wisdom going back thousands of years universally states that you should save your money and avoid going into debt. Take for example the financial principles taught in the bible:

- Spend less than you earn - Proverbs 13:11

- Avoid the use of debt - Proverbs 22:7

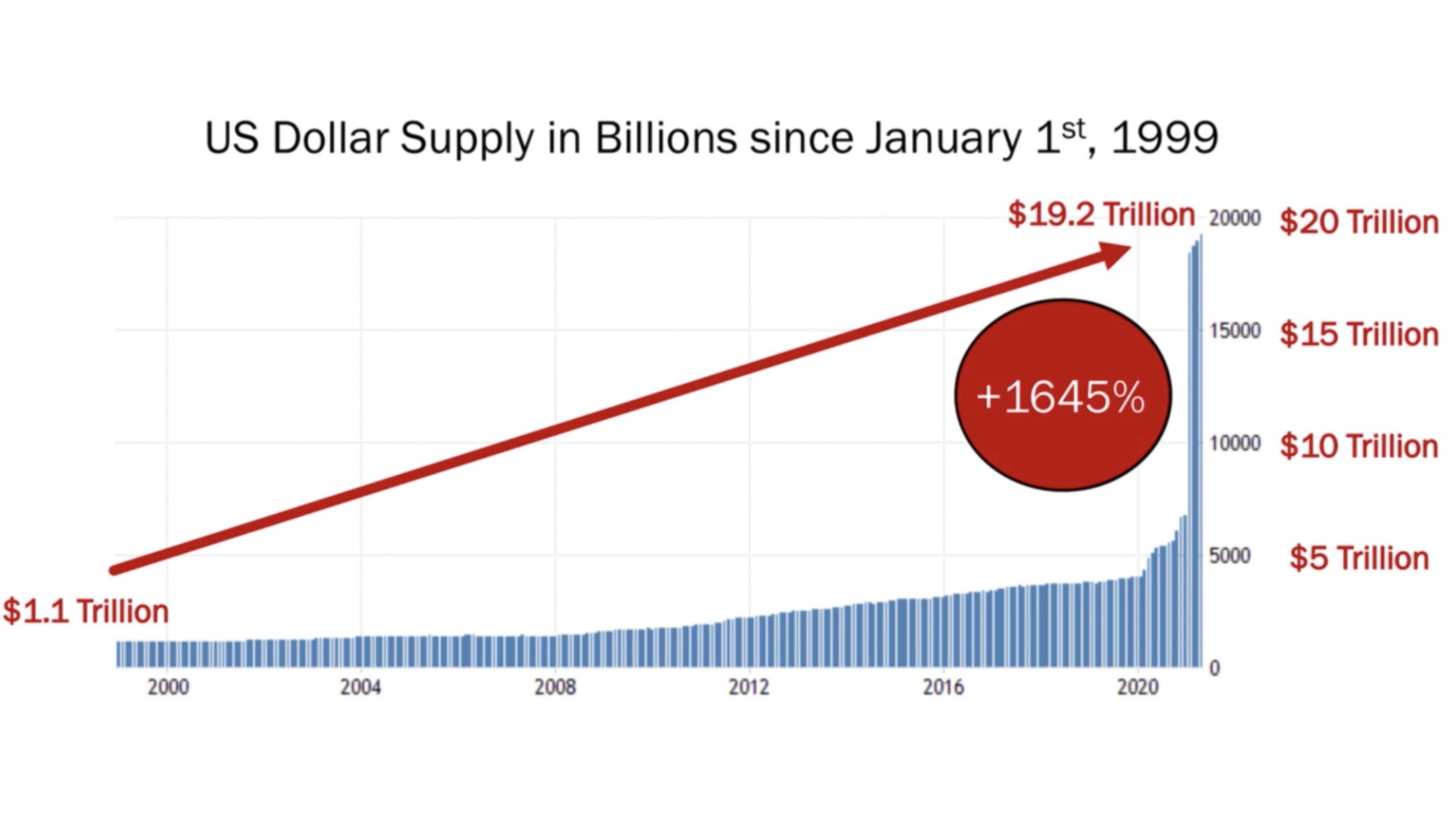

Nowadays the only person you will find telling you to save your money and to avoid going into debt is Dave Ramsey. However, in today's modern monetary system you do not need to be a financial expert to question this age-old-advice. All it takes is a quick look at a graph of the US dollar supply to understand the problem.

If you save a set amount of US dollars and the US Federal Reserve increases the total supply of US dollars then proportionally your savings will be negatively impacted through decreased purchasing power. So, if this is the case then how come for thousands of years, we were advised to save our money and to avoid going into debt? Is it possible that the prevailing wisdom of the past was wrong?

Money vs. Currency

The answer is of course, no, but to understand why we must first understand the difference between money and currency. In today's monetary system, no country on earth uses money, they all use national fiat currency. For something to be money it must meet all of the following criteria:

- Medium of Exchange

- A Unit of Account

- Portable

- Durable

- Divisible

- Fungible (Interchangeable)

- STORE OF VALUE

- Weimar 1923

- Hungary 1946

- Yugoslavia 1994

- Zimbabwe 2008

The Difference Between Currency and Money...

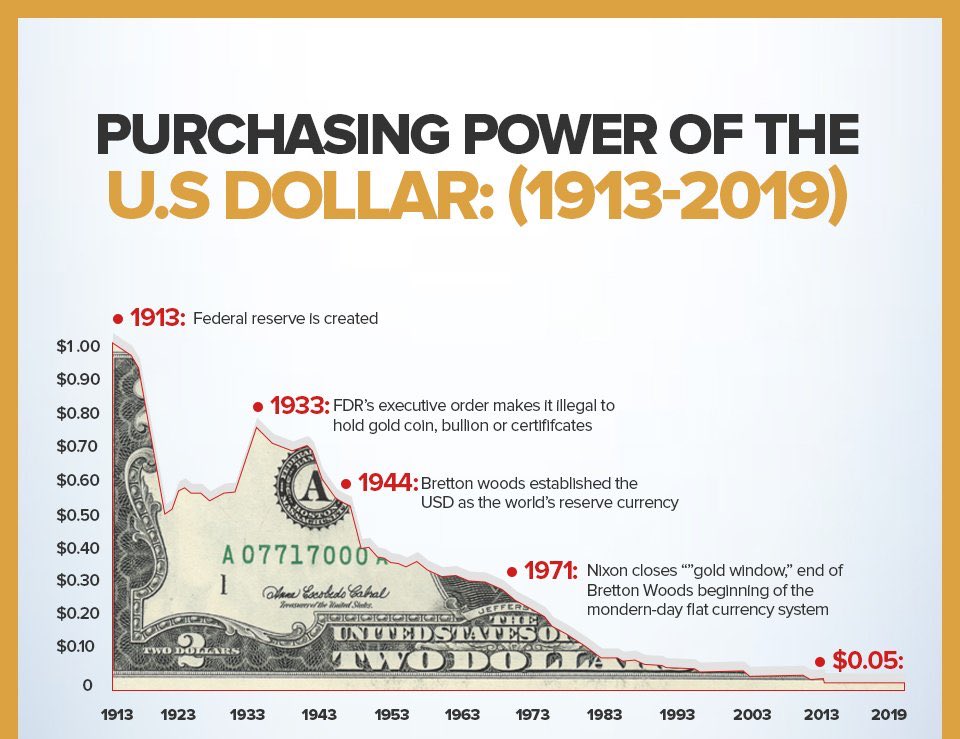

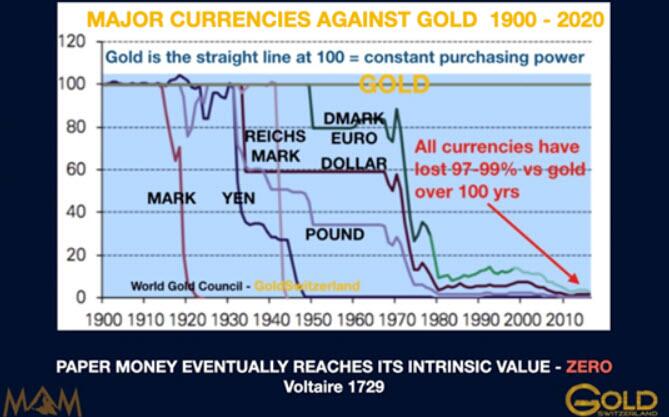

Today currencies are no longer redeemable for gold but are only based on confidence. In other words, they are backed by nothing. Money must be a store of value and if you look at a graph of the US dollar's purchasing power over time you can see that it is failing.

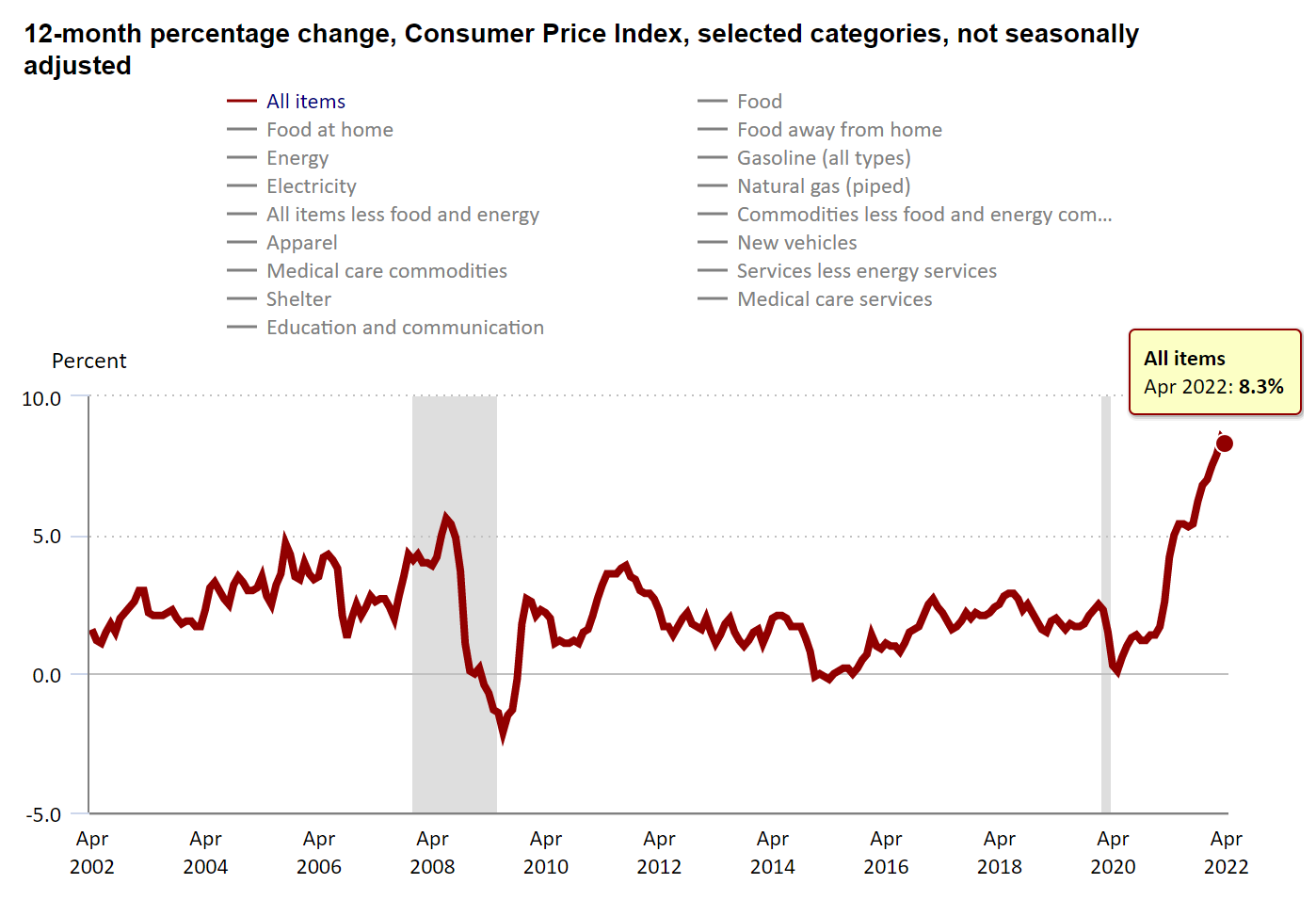

The most recent CPI numbers show that this devaluation of the dollar is only speeding up.

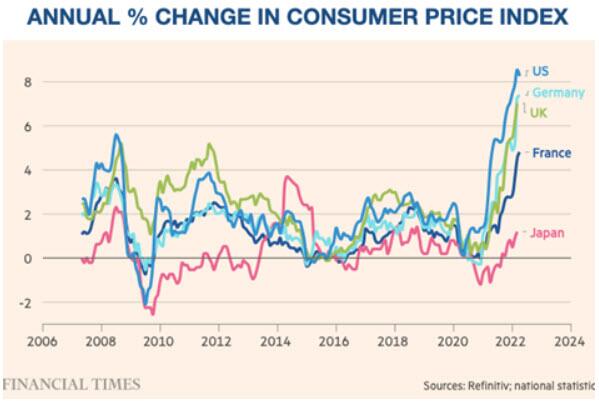

All other currencies are pegged to the US dollar which makes this a global issue.

Using logic we can further illustrate how gold is money. The Monetary Regression Principle was formulated by Austrian School economist Ludwig Von Mises in his 1912 book, The Theory of Money and Credit.

How do you know what prices are?

When you wake up in the morning you know basically how much everything costs and you know how much you need to work in order to buy the things you need and want. You know this only because you extrapolate from yesterday's prices. Connecting prices today to yesterday's prices. All prices of all things must have some reference point into the past otherwise prices are meaningless. By the Monetary Regression Principle, the prices of all goods and services have some reference point to prices in the past and today those prices are denominated in national fiat currencies that regress to gold. By the regression principle, dollars are still indexed to gold, see the price of gold today here.

What is Wealth

Your true wealth is your time and freedom. Money is simply a trading tool that stores economic energy, your time and freedom, whereas currencies leak them away. Gold is the ultimate money, simply because of its properties. Fiat currencies are based solely on confidence, and always return to their intrinsic value of zero. Rising prices are a symptom of an expanding currency supply and gold has historically always accounted for an expanding currency supply.

So now that we know the difference between money and currency, we can see that our modern society rewards debt and punishes those who save in currency. The age-old financial advice that states you should save and avoid going into debt sounds foreign in today's world because it is bad advice if you save currency. This departure from sound money to currency inverts the historic fundamentals of money. However, just because Nixon took the world off of the gold standard that does not mean that we cannot take matters into our own hands and create our own personal gold standard.

Personal Gold Standard

When living on a personal gold standard you take on a different operational mentality, strategy, and overall approach to lifestyle when compared to the average investor. By removing the scales from your eyes that were placed there by Governments and Central Banks you begin to see currency for what it really is, and you can finally see that the Emporor has no clothes on. This brings clarity to financial advice from decades past and helps one to remove the fog and confusion that so often comes along with trying to understand how money works.

To better understand the implicaitons of living under a personal gold standard let us explore the idea further through the three financial actions investors take:

- Saving

- Debt

- Investing

Saving

Historically a system benefits when operating on a foundation of sound money, also known as a gold standard. In comparison to a trust based fiat currency system. In comparison to a trust based fiat currency. A hard money system benefits by rewarding savers instead of incentivizing borrowers. When currency is created out of thin air the existing currency in circulation is diluted over time and this punishes savers by devaluing the purchasing power of their savings. On the flip side of the coin this currency creation benefits riskier behavior and borrowers are rewarded because as time goes on their debt becomes easier to pay off. This creates a system that is built on debt as opposed to a system built on savings which becomes very fragile when that debt needs to be paid back.

Additionally, a hard money system benefits society by providing a true measure to compare investment returns against. In a currency-based system if your currency is losing X percent of its value annually then the dollar amount does not change but the purchasing power does. For example, if you are investing in something that provides a two or three percent return then in dollar terms you are getting a posiive return but when compared against its actual purchasing power you are actually getting a negative return. This means that in a system that can have an infinite supply of currency, where the value of that currency continues to go down over time there is a massive amount of currency that is going into investments that are providing a nominal positive return in terms of dollars, but in real terms of purchasing power they are actually negative returns. This added layer of deception incentivises investment into wealth destroying investments. Investors are simply destroying their wealth slower than if they had just left their wealth tied up in dollars to have the leaky currency destroy the purchasing power.

Conversely, a hard money system incentivises investment that actually produce a real return. Even if the real return is only one percent that is better than what the money would do over time which is to slowly appreciate in terms of purchasing power. See the graph below as a reminder of what happens to currencies purchasing power when compared to gold.

Now that we understand the advantages that a hard money system has over a fiat currency based system, we can implement a personal gold standard to take advantage of the benefits. This allows us to not have to worry about or rely on the system doing things the right way. If you do things the right way, independent of the system, then you can reap the benefits.

Savings is often confused with both investing and loaning money. They are all different. Saving, debt, and investing are three seperate things you can do with money and they are not at all the same thing. An example of savings is keeping money in a safe at home. An example of debt would be borrowing money, for example borrowing money to buy a house or a car. However, most people do not realize that they are actively engaged in loaning money. When you put money into a checking account you are loaning money to the bank. When you put money in a savings account or a CD that is also a form of loaning. By putting money into these financial instruments, you are actually loaning money to the institutions and they can use that money to turn a profit and pay you an interest rate on the money that you have loaned them. When you buy a bond, be it a corporate bond, a municipal bond, or a federal bond that is loaning money. Loaning money to a company. Loaning money to a city. Loaning money to the federal government. Whatever type of loan it is you are going to be paid an interest rate for the duration of that loan and these are all forms of debt. Investing is something entirely different. When you loan someone money that is not an investment, that is debt. When you save money that is also not an investment. They are three seperate things and for now we will continue to focus on saving.

In our current system saving is discouraged because currency acts as a mask that vails the fundamental ways that money works because we the public are viewing prices through the lens of currency. We do not realize that there are two separate things at play, gold (real money), and currency, and they are not the same thing. So now when you hear someone like Dave Ramsey tell you to save and avoid going into debt you should ask yourself the following. Why would I save bank notes that are backed by nothing and which I know they are going to just print more of that will further destroy the purchasing power of my savings? The better thing to do would be to save as little as possible just like all the rich people do and to take out debt to buy investments. Our current system is set up to incentivize this type of financial behavior but as noted above this builds a poor financial foundation and adds fragility to the system. Your gut reaction is correct, you should avoid saving currency, bank notes backed by nothing. However, on the other hand the fundamental laws of money that traditional advice hints at still stands. We should save real money not fake money backed by nothing. Currency is not money, when you save money what that is really referring to is saving gold.

Gold is money because of its properties and will always out perform currency because it is a store of value over long periods of time. Gold has a finite supply, it cannot be created at will, there is a cost of labor for extracting it out of the Earth, and it is almost impossible to destroy. It does not rust or decay unlike a lot of other commodities and metals that can get used up, and there is a lot less of an industrial use for gold as opposed to precious metals like silver so the actual value does not fluctuate as much because it is not dependent on other industries.

When you put your savings into gold instead of into cash, what you are doing is you are building up a store of wealth that will persist over time without leaking value. Not only will it persist, but it will slowly appreciate in terms of its purchasing power. Now for a lot of things it will not appreciate in terms of its purchasing power. This applies to things that do not change with technological advancements or things that become cheaper through efficieny and increased productivity. For example, an old rule of thumb that many investors use to demonstrate the stability of gold's purchasing power is the gold-to-decent-suit ratio. In ancient Rome, an ounce of gold could buy a toga for a senator. In 1960 a businessman could buy a suit for $35 - the cost of an ounce of gold. Today a high-end three piece fitted suit costs around $1800, or an ounce of gold. Golds purchasing power persists over time.

This persistence applies to wages as well. Going back to ancient Rome, a roman centurion was paid between thirty-five and forty ounces of gold for their yearly wages and in terms of todays dollars that translates to somewhere between sixty and seventy thousand dollars. Which is a comparable wage to todays soldier.

Actual appreciation in purchasing power in terms of gold can be seen in technological advancements and when things become cheaper through efficienty and improved productivity. This would include such things as improvements in manufacturing and farming techniques. There are many such efficienty improvements in today's goods and services that we do not see in cost savings because they are masked by the dollars losing value faster than the productivity gains. When you put your savings into currency you lose purchasing power over time and your wealth is leaked away by the speed at which more currency is added into the system. Whereas when you store your savings in gold your purchasing power is preserved over time.

While it is self-evident to see the advantages of saving money in gold as opposed to cash you still cannot get paid directly in gold. To truly live on a gold standard, you would need to convert your paycheck from currency into gold and when you wanted to purchase something you would need to convert from gold back into currency. There are companies out there that are trying to bridge this gap by providing a service that will allocate your savings into physical gold and allow you to transact using a gold backed debit card. As currencies around the world are further debased, it is reasonable to suspect demand for these services will only increase.

While you wait for these services to improve you can continue to save in physical gold. Work towards having six months of savings for emergencies or more if you are saving up for a larger investment. Keep a checking account open with a bank or preferably a local credit union where you have a month of cash savings stored. This account is also used to collect your paycheck. Then after you have paid your expenses save the remainder in physical gold. If you were to instead store your savings in a savings account, then you would just be loaning money directly to the bank for a negligible nominal rate of return. That would of course be a negative real return.

Debt

There are two sides to debt when dealing with a hard money system. One side is borrowing money, and the other side is loaning money. Within each of these categories we will be comparing gold to currency.

Borrowing Currency

Under the current monetary system it is extremely profitable to borrow dollars and to deploy those dollars into investments. In terms of its purchasing power, fiat currency decreases over time. For example, if you look at historical home values you will notice that an average American home purchased in the 1960s cost around $20,000 where as that same house today would cost around $370,000. This is a direct reflection of the dollar losing its purchasing power. So when you hear people complain about how much they have to pay today versus fifty years ago you need to tell them to shift their perspective. This is simply a result of the dollar going down over time which means when you borrow dollars, over time it becomes easier and easier to pay back. This is because you are paying back that debt with less purchasing power than what you originally borrowed. Debt is easier to pay off in a fiat currency system. This is why the Federal Reserve continues to print more money, becuase the govermnet is loaded with debt and they need that debt to become easier and easier to pay off. The alternative is defaulting on their obligations. Once you make this connection you will realize that this system can only continue in this direction and eventually it will break. When this happens, the government will be left with only two options. Save the economy, or save the currency. History shows that government always chooses to save the economy.

However, that is out of our control so in the meantime we can use this knowledge of how the system works to our advantage. When you borrow currency in a fiat-based economy that debt becomes easier to pay off over time. This holds as long as you avoid purchasing bad debt. For example, if the currency is depreciating at two percent per year then you are not going to want to borrow money to purchase something that loses more than two percent, like a new car for example. This is because when you go to sell that car you will have a lot less purchasing power available to you to pay back that debt. So a good rule of thumb to use when borrowing dollars is to use the rate of devaluation of that currency as the bar for what you deploy those dollars into. An example of a good use of debt would be by purchasing a piece of real estate. This investment will provide rental payments that can be used to cover the debt on the loan and over time that debt will become easier and easier to pay off because what you deploy your dollars into is either gaining in real value or it is losing value slower than the dollars that you borrowed.

Borrowing Gold

Just like you can borrow fiat curreny, you can also borrow gold. However, you should never borrow gold. I will repeat this, NEVER BORROW GOLD! This is where the ancient financial wisdom rings true. For all of history money was gold and that meant that over time money appreciated in value. When you borrow gold, it is more difficult to pay back that loan the longer that loan exists because you are having to pay it back with more purchasing power than you originally borrowed. Borrowing gold is the opposite of borrowing cash. When discussing debt, the difference between gold and currency becomes obvious and the historical advice proves to have been right all along. This is because there is a difference between money and currency. So, the age-old advice still applies. Do not go into debt with money and do not borrow money. While we use currency today there are services that will let you borrow against your gold. This means that when you pay back your debt you are paying back in terms of ounces of gold which retains its purchasing power in relation to the dollars you borrowed against it. This means that it becomes harder with time to pay back that debt.

Loaning Gold

If you borrow money in gold it is difficult to pay back but through that same transaction we observe that it is profitable to be the party that lends the gold. This is because with the money that you are lending you are getting an interest rate plus the increase in purchasing power that you are guaranteed to get back through your ounces of gold. So not only are you getting increased purchasing power over time plus the interest rate in the transaction, but you are also holding gold collateral in the event that the borrower cannot pay back the debt. This guarantees that you at least get your purchasing power back.

Today, in our currency dominated system, people lend money when they keep savings in a savings account or when they buy bonds. This is an inferior method of loaning money. If you want to take advantage of the lenders side of the debt transaction you should lend gold. This guaratees you get your purchasing power back when you are paid back in ounces of gold borrowed, you get interest, and there is collateral.

Loaning Fiat Currency, Dollars

Loaning dollars or fiat currency is unprofitable. This is why banks so often face collapse and why they can only stay in business through the help of central banks like the Federal Reserve. This is why the Federal Reserve continues to devalue the dollar by adding to the total supply of dollars in circulation. The likelihood that you will get an interest rate that will exceed the rate at which those dollars are losing value is virtually zero. Traditional lending through a savings accounts or by buying CD's and Bonds are all examples of loaning cash. When you participate in this type of traditional loan there is very little likelihood that you will regain your original purchasing power when comparing the value that those dollars have lost. In real terms, purchasing power, you actually lose value by lending dollars.

So in regards to debt, there are four components. For fiat currency there is borrowing dollars and there is lending dollars. For gold there is borrowing gold and lending gold. These pieces are opposites of each other. You should lend your gold, but you should avoid lending your dollars. You should borrow in dollars, but you should avoid borrowing in gold.

This can be understood by observing real returns. The real return of cash is steeply negative. The real return of gold is slightly positive. This means that you want to avoid obligations that put you on the hook for paying back something that appreciates in value over time. You do want to take advantage of the ability to borrow something that you can pay back with something less than you borrowed in terms of its purchasing power.

Investing

When deploying money into investments in a fiat based monetary system such as we have today your goal is to get a return on your investment. Because you now know about real money, gold, and its inverse relationship to currency you now have a bar that you can judge your investments against. This is the rate of depreciation of currency. To retain your purchasing power, your wealth, you must only deploy your money into investments that will yield a greater ROI than the rate of depreciation of the dollar.

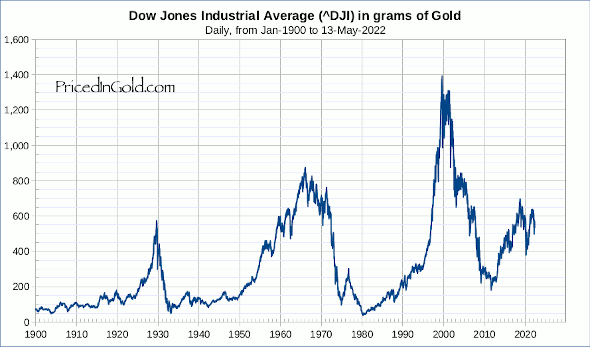

Investing through the lens of a gold standard looks very different than investments viewed through the lens of fiat currency. In a system where dollars depreciate over time you must beat the rate of depreciation with your investments ROI. If you put your money into a CD and you get a two percent ROI then if you only think in terms of dollars then you might be satisfied with this ROI. But the investor that disciplines themselves to a gold standard will look at the rate of inflation in their area and quickly realize that a two percent ROI is a bad investment. You would actually be losing a lot of your purchasing power over time. This logic applies to investments in stocks that give a five, six, and even seven percent rate of return. Even in these investments you could still be destroying your wealth and losing real purchasing power over time when you realize that you can only purchase a fraction of what you could with that same money you used to make the initial investment. This means that to make smart investments you should look through the lens of a hard money system. Investments that give a positive ROI will stand out when compared to something that does not lose its purchasing power over time, but slightly appreciates. This exercise will wake you up to the startling fact that most appreciation and long term capital gains are largely a mirage and for the most part they do not realy exist.

Look at this chart of the DOW Jones Industrial Average priced not in terms of dollars, but in terms of gold. Historically the DOW always comes back down to around one ounce of gold. There are brief periods of time where there are large bubbles blown up in the valuation of companies that are included in the DOW but eventually, they revert to the mean and you can buy the DOW for around one ounce of gold. It should come as no surpise that when you look at the best companies and measure them in terms of innovation that they only show 2-3% annual improvements.

To further drive home this point let us look at a hundred-year chart of the DOW priced in dollars that shows a graph that trends up and to the right. What you are really looking at when you view this chart is a devaluation of the currency. This is a graph that illustrates the fact that it costs more dollars to buy investments today than it did the day before. This is not because these investments have gained in value but because the dollars purchasing power has been destroyed. So when you listen to so called financial experts tell you about how we do not actually care about daily draw downs and that we are in the markets for the long term appreciation, you now know that they are deceiving you! Long term there is no appreciation, long term things revert to the mean. So if the only thing that you are banking on when investing for your retirement is appreciation then you are effectively gambling.

Take a company like Amazon. If the goverment decides to declare it a monopoly and they decide to break up the company then all of your gains that you have accumulated over the years could be gone over night. This is especially apparent when you compare the purchasing power you are left with to your initial investment.

If you cannot count on capital appreciation when investing, then how should you invest your money? If you are a student of history then the answer should come as no surprise to you. Historically the wealthy do not invest for appreciation but for cashflow and income. Income is the answer. Be it dividends from stocks, rental income from real estate, or profits from owning a business. Income is the only way to ensure that you start to collect a real return on your investment.

People have made a lot of money through speculation which is what investing for appreciation is, but a lot more people have lost money this way. That is why time old financial advice does not value it as a reliable means to build wealth. All the proof you need as an individual investor is the above graph of the DOW priced in gold. If it were possible to pick all the companies that hit the lottery and experienced massive growth and to avoid all of the other companies then you would never need something like an index fund to exist. However, the fact that index funds do exist and show total system returns and the fact that those total system returns revert to the mean or about one ounce of gold for the DOW, shows that as an individual investor the only reliable way to get real returns on investments is to invest for cashflow and income, not for appreciation.

You should only deploy your money into investments when their ROI is greater than the value of the debt or cash losing its purchasing power. For example, contrary to what banks want you to think when you take out a loan to buy your first home. When they tell you that your home is your greatest asset, what they really mean is that your home is their greatest asset. Yes, your home will go up in value over time, but this is only a reflection of the loss in purchasing power of the dollar. This is why your home should never be tied to your net worth, it is not an investment. You are only speculating that you are going to be able to sell your home to someone else at a greater price which is gambling. So when you take out cash a good investment would be to deploy that into an investment like a rental proprety. This is a reliable investment because the cash flow from the tenant pays the debt on the property. To make it simple, the bar of entry when considering an investment deal is that the cash flow you are receiving is greater than the cost of servicing that debt. The larger the margin, the safer the investment. This investment is an example of how you can build your wealth because once the debt has been paid off you will be left with at least some value in the property, and you will still have cash flow from the property that will serve as income. Income is the only reliable way to make sure you can service the debt if you decide to use debt to purchase an investment. This income is often used as the bar to ensure using debt is a good idea.

He also said, "Money is gold and everything else is credit." Fiat currency is just credit. When you use currency, you are relying on the good faith of the US government to not do what it has always done, which is to devalue the currency. In conclusion, disciplining yourself to a gold standard allows you to make smart financial decisions that are in line with age old financial advice. If you are saving, save gold. If you are loaning, loan gold. If you are borrowing, borrow fiat currency. If you are investing, invest for cash flow that provides a real return over the cost of the debt if you are using debt. If you are not using debt, then invest for immediate real returns. This will keep you from speculating and relying on the greater fool theory that states there is always a greater fool for you to sell your investment to at a higher price. By following this advice, you will avoid being tricked by appreciation in terms of dollars only because you are holding everything to the standard of gold and how it is performing.

If you found this article interesting and would like to share a comment with me, please feel free to reach out to me directly via my personal email at (drew@drewredifer.com).

Return to